Saving is the same as investing

One of the biggest misconceptions in the financial world is that saving and investing are the same thing. Saving means putting aside an amount of money for future use, while investing means putting that money to work for a profit.

It is true that saving is important for having a financial cushion and being able to deal with unforeseen events, but if you want to increase your wealth, you need to invest. Investing allows you to earn interest, dividends, or capital gains, which increases your wealth in the long run.

Of course, there are risks involved in investing and not all options are suitable for all investor profiles. This is why it is important to be well informed and seek professional advice before making any decisions.

Investing is not only for the rich

This myth is very common, but it is completely false. Anyone can invest, regardless of their income level. In fact, investing can be a great way to grow your money and achieve your long-term financial goals.

You don't have to be a millionaire to invest. There are many investment options available for people with different income levels and budgets. For example, you can start investing in mutual funds or the stock market with as little as a few dollars.

And investing is not just for the rich because there are also investment tools that allow you to invest small amounts of money over time, such as automatic savings plans.

These plans allow you to invest small amounts of money each month in an investment account and watch your money grow over time.

Don't be discouraged from thinking that investing is only for the rich. Anyone can invest and grow their money over the long term.

Investing is too risky

This is one of the most common and dangerous myths, as many people believe that investing their money is an extremely risky activity. However, the truth is that not all investments are equal and each one has its own level of risk.

It is true that some investments can be riskier than others, but it is also true that most investments have a moderate or low level of risk. Moreover, risk can be reduced by proper diversification of the investment portfolio.

The fact is that not investing is also risky, because money loses value over time due to inflation. Therefore, if you want to protect your wealth and make it grow in the long term, investing is a necessary and intelligent option.

Of course, you should always seek information and advice before making any investment to minimize risks and maximize returns.

You only need to save for retirement

This is one of the most common myths about saving and investing. Many people think that if they save enough for retirement, they will be financially secure. However, this is not entirely true. Saving is important, but it is not enough.

You have to take into account other factors, such as inflation, taxes, and unforeseen events along the way. This is why it is important to diversify your investments and seek financial advice to make informed decisions.

Don't just focus on saving for retirement, think about how you can invest your money wisely and ensure a sound financial future.

You need a lot of money to start investing

This is one of the most common myths about investing. Many people think that to start investing they need to have a large amount of money, but this is not true.

In reality, there are many investment options that require very little initial capital. For example, you can start investing in mutual funds with as little as $50 or $100.

You can also buy fractional shares, which means that you can buy a portion of a stock instead of buying the entire stock.

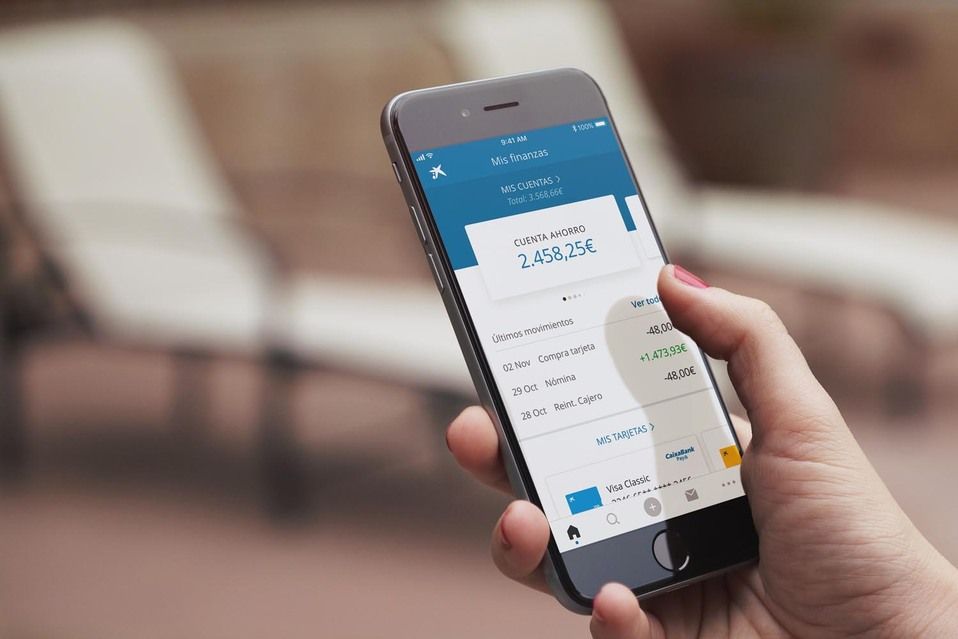

Another option is to use mobile investment apps that allow you to invest small amounts of money in different options, such as stocks, mutual funds, and cryptocurrencies.

The important thing is to start investing as early as possible, even with small amounts of money. Over time, your money can grow by a significant amount.

You should concentrate on only one investment

This myth is dangerous because it can lead to a lack of diversification in your investment portfolio. If you concentrate on just one investment, you are putting all your eggs in one basket, and if that investment fails, you will lose all your money.

It is important to diversify your investment portfolio to reduce risk. This means investing in different types of assets, such as stocks, bonds, real estate, and commodities. You can also diversify within each asset class by investing in different companies or sectors.

No single investment is perfect for everyone. Your portfolio should be tailored to your financial goals and risk tolerance. A financial advisor can help you create a well-diversified portfolio that meets your needs.

Investments are only for the short term

This myth is very common among people who believe that investing is synonymous with quick and easy returns. However, the reality is that investments can also be long-term and offer significant returns.

For example, investing in the stocks of solid, well-established companies can generate long-term returns. In addition, investing in diversified mutual funds can offer stable returns over time.

It is important to remember that any investment involves a certain degree of risk and that results may vary. Therefore, it is important to do thorough research and seek financial advice before making any investment decisions.

Investments are only for financial experts

This myth is completely false. Anyone can invest, regardless of their level of financial knowledge. It is true that experts may have an advantage in terms of experience and knowledge, but this does not mean that beginners cannot invest successfully.

Today, there are many tools and resources available to help beginning investors make informed decisions and build their portfolios.

In addition, there are many different types of investments available, from stocks to mutual funds to bonds, which means there is something for all levels of risk and experience.

The most important thing is to educate yourself about the investment options available and make informed decisions.

It is also important to keep in mind that investing involves risk and that there is always the possibility of losing money. But with the right research and a sound strategy, anyone can invest successfully.