1. Mint

Mint is one of the most popular apps for tracking your spending and investments. This app allows you to connect all your bank accounts, credit cards and investments in one place so you can see your financial situation in real time.

In addition, Mint helps you create a personalized budget and sends you alerts when you are close to exceeding your budget or when there are unexpected charges on your bills. You can also receive personalized advice on how to save money and improve your financial situation.

The app is free and available for iOS and Android. Meanwhile, Mint makes money by offering you personalized financial service offerings based on your spending and investing habits.

2. Personal Capital

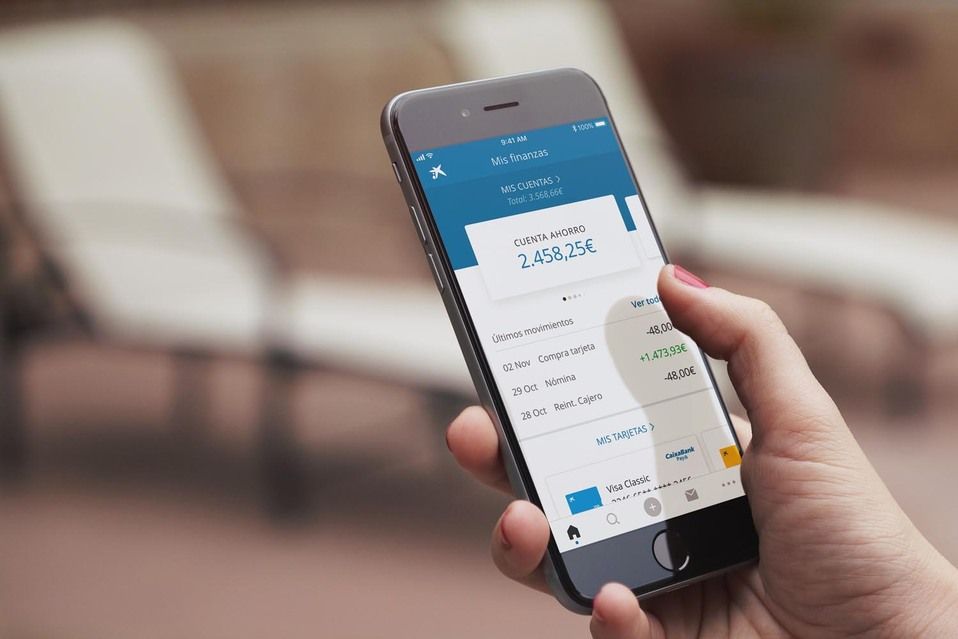

Personal Capital is a free mobile app that allows you to track your personal finances easily and efficiently. With this tool, you can view your bank accounts, credit cards, investments and loans in one place.

In addition, Personal Capital provides you with analysis tools to help you better understand your expenses and income, and gives you personalized recommendations to improve your financial situation.

Another interesting feature of this app is that it allows you to track your investments in real time, with detailed charts and analysis to help you make informed decisions.

In summary, Personal Capital is an excellent choice for those looking for a simple and effective way to track their spending and investments from their mobile device.

3. PocketGuard

PocketGuard is a free app that takes care of organizing your finances automatically. It connects all your bank accounts, credit cards and investments so you can see everything in one place.

It also shows you a daily summary of your spending and income, and alerts you when you are close to exceeding your budget.

You can also set financial goals and PocketGuard will help you achieve them by showing you how to save money in different areas. The app uses banking security technology to protect your data and does not store sensitive information on your mobile device.

4. YNAB

You Need a Budget (YNAB) is a mobile app that helps users create a personalized budget and keep track of it. With YNAB, you can set financial goals and track your daily expenses to make sure you're on track. The app also offers tools to help you save money and reduce your debt.

5. Wally

Wally is a free app that allows you to track your daily and monthly expenses. The app allows you to enter your income and expenses manually or scan your receipts for easy tracking.

Wally also has a budget feature that helps you set spending limits for different categories, such as food, transportation, and entertainment. The app also gives you detailed reports on your spending habits and offers tips for improving your budget. Wally is available on iOS and Android.

6. Acorns

Acorns is an app that helps you invest your money wisely. With this app, you can link your credit or debit card, and every time you make a purchase, Acorns will round the amount to the nearest amount and invest it in an investment portfolio customized to your financial goals.

You can also make additional deposits and choose from different investment portfolios based on your risk profile. Acorns charges a monthly fee of $1 to $3, depending on the plan you choose.